EMPLOYMENT LETTERS AND RETIREMENT AGREEMENTS

Brian Lynch

In connection with Mr. Lynch’s promotion, Mr. Lynch has an employment letter with the Company dated June 1, 2017, and effective August 1, 2017. The material terms of the employment letter are summarized below.

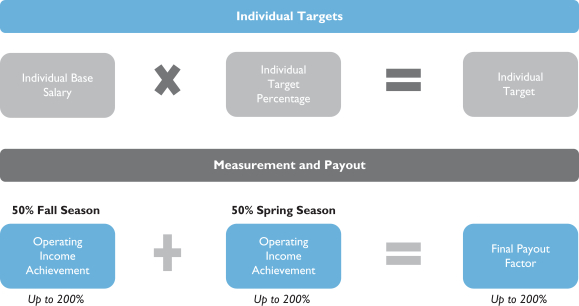

Mr. Lynch will receive an annual base salary of $1,000,000, and will be considered for an annual performance evaluation beginning in the fall of 2018. Mr. Lynch will continue to be eligible to participate in the Company’s seasonal performance-based incentive compensation program and, beginning with the Fiscal Year 2018 fall season, his target bonus opportunity was increased to 125% of annual base salary, with a maximum annual payout at two times the target level.

Subject to Compensation Committee approval, Mr. Lynch will continue to be eligible to receive annual equity grants effective September 2017 in connection with his promotion to CEO-ascena brands are subject to the form of stock options, RSUs or performance-based awards, and will havefollowing terms:

Mr. Muto’s received a target level equal to 250% of annual base salary.

The employment letter provided for an additionalone-time grant of 1,000,000 restricted stock units effectiveRSUs (“One-Time RSU Grant”) in September 2017, that will vest 50% of which vested on June 30, 2019 and the remaining 50% of which will vest on June 30, 2020, in each case, subject to continued employment through each applicable vesting date.

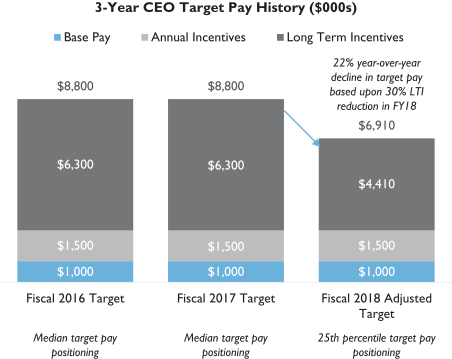

Gary Muto

In connection with Mr. Muto’s promotion, Mr. Muto has an employment letter with the Company dated June 1, 2017, and effective August 1, 2017. The material terms of the employment letter are summarized below.

continued service;Mr. Muto will receive an annual base salary of $1,000,000, and will be considered for an annual performance evaluation beginning in the fall of 2018. Mr. Muto will continue to be eligible to participate in the Company’s seasonal performance-based incentive compensation program and, beginning with the fiscal year 2018 fall season, will have an increased target level equal to 125% of annual base salary, with a maximum annual payout at two times the target level.

Mr. Muto will continue to participate in the Company’s Transformation Bonus Program (see “Compensation Discussion and Analysis – Transformation Bonus Opportunity” for additional details). In connection with his promotion, Mr. Muto will be eligible for a payout equal to an additional multiple of his August 1, 2017 base salary as follows: 0.25 for fiscal 2018; 0.3125 for fiscal 2019; 0.375 for fiscal 2020; and 0.4375 for fiscal 2021.

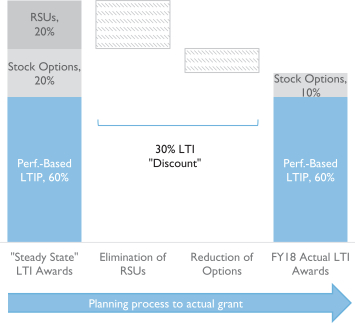

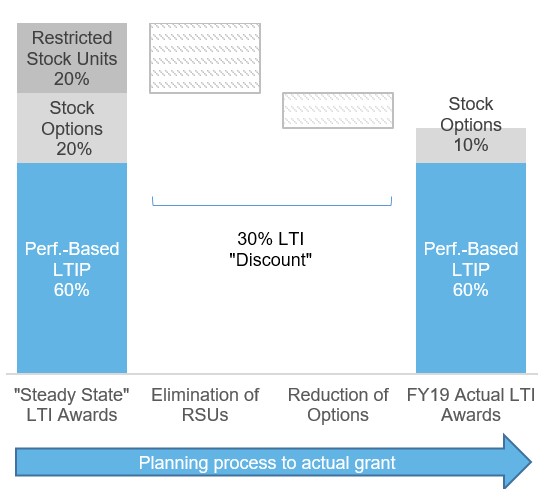

Mr. Muto was entitled to receive an annual long-term incentive grant effective in or about September 2017 having an estimated total value of $2.5 million, (the “2017 Annual Grant”). The 2017 Annual Grant may consistwhich consisted of stock options, RSUs, performance-based awards or such other incentives as determined by the Company. Awards that are not performance based vest in equal annual installments over a three-year period (“2017 Time-Based Awards”), and awards that are performance based (“2017 Performance-Based Awards”) vest on the third anniversary of the grant date subject to the achievement of the applicable performance goals. Accordingly, ingoals (“2017 Performance-Based Awards”). In September 2017, Mr. Muto received: (i)received a 2017 Time-Based Award consisting of 360,825 stock options, which vests in equal installments on the first and second anniversaries of grant and 2017 Performance-Based Awards consisting of a FY20 LTIP award with a grant date fair value of $1,075,000 subject to a1-year net income goal and a2-year post-performance vesting condition; (ii)condition and a FY20LTIP award with a grant date fair value of $1,075,000 subject to a3-year relative TSR goal; and (iii) an award of 360,825 options, which vests in equal installments on the first and second anniversaries of grant.

goal.Mr. Muto received an additionalone-time grant of 1,000,000 restricted stock units(“One-Time RSU Grant”) in September 2017 that will vest 50% on June 30, 2019 and 50% on June 30, 2020.

The 2017 Annual Grant (i.e., the 2017 Time-Based Awards and 2017 Performance-Based Awards) and theOne-Time RSU Grant generally require continued employment through the vesting date, except that,If, prior to a change in control, if the Company terminates Mr. Muto’s employment without “Cause”“cause” or Mr. Muto resigns for “Good Reason” (in each case, as defined in the employment letter),“good reason,” (i) the next tranche of any then outstanding unvested 2017 Time-Based AwardsAward andOne-Time RSU Grant that is scheduled to vest after suchthe date of termination will vest on the date of such termination and (ii) apro-rata portion of any then outstanding unvested 2017 Performance-Based Awards will vest subject to actual achievement of the applicable performance goals determined after the end of the performance period.

Mr. Muto is conditionedsubject to one-year non-competition and two-year non-solicitation restrictions, as well as confidentiality and non-disclosure obligations.

Mr. Muto will continue to be a participant in the Company’s Executive Severance Plan, on his timely executionthe terms described below under the heading “Executive Severance Plan,” as modified by the Muto Offer Letter.

For further information regarding Mr. Muto’s employment arrangements and the payments to which he may be entitled thereunder, see below under “Potential Payments Upon Termination or Change in Control - Gary Muto.”

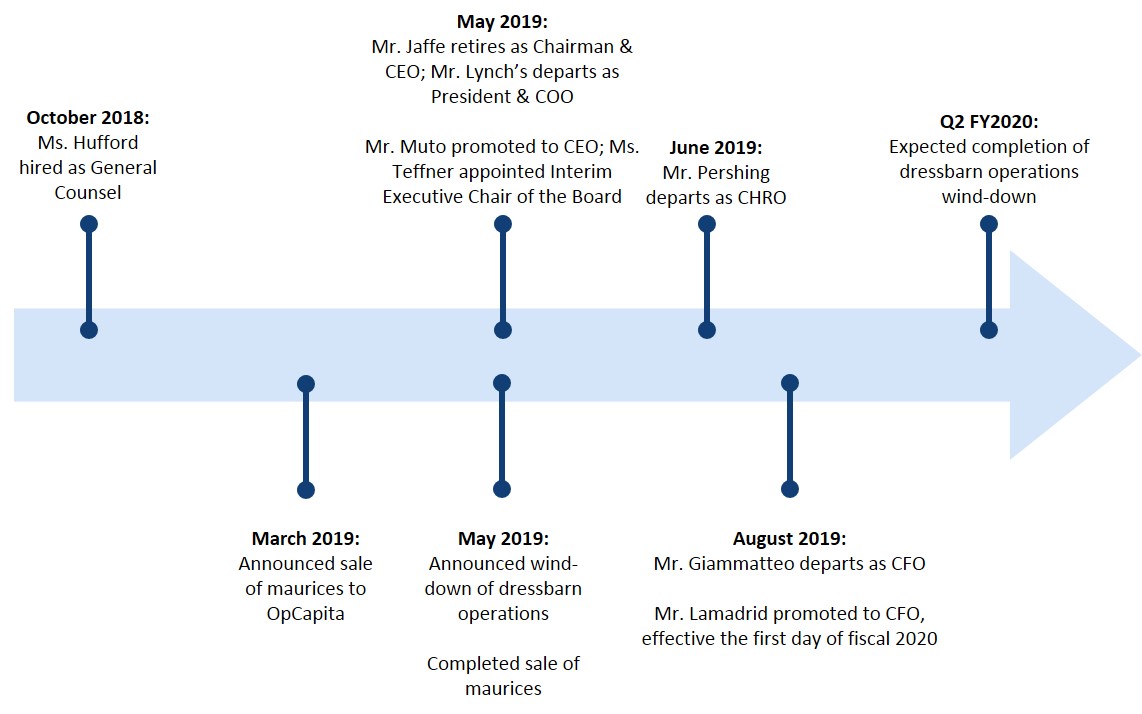

Carrie W. Teffner

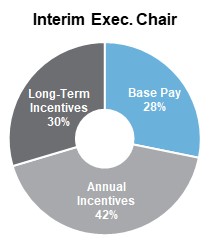

Effective May 1, 2019, the Company entered into an employment letter with Carrie W. Teffner in connection with her appointment as Interim Executive Chair of the Board (the “Teffner Offer Letter”).

Pursuant to the Teffner Offer Letter, Ms. Teffner receives a base salary at the annualized rate of $1,000,000 and is eligible to participate in the Company’s performance-based incentive compensation program at a target level of 150% of her base salary (with a maximum payout opportunity of 200% of target, or $3,000,000).

As set forth in the Teffner Offer Letter, Ms. Teffner received a one-time long-term incentive award of performance-based equity (the “Appointment Grant”) under the Omnibus Incentive Plan. The Appointment Grant had a grant date value of $1,050,000, with approximately 60% of the value granted in the form of performance-based RSUs and approximately 40% of the value granted in the form of performance-based stock options. Subject to Ms. Teffner’s continued employment as Interim Executive Chair of the Board or service as a member of the Board, the performance-based RSUs and performance-based stock options subject to the Appointment Grant are eligible to vest in accordance with the same vesting schedule that applies to Mr. Muto’s Promotion Grant, described above.

If Ms. Teffner’s employment as Interim Executive Chair of the Board ends due to the appointment of a restrictive covenant agreement containingNon-Executive Chair of the Board and Ms. Teffner continues to serve on the Board, the performance-based RSUs and performance-based stock options granted pursuant to the Appointment Grant will remain outstanding and eligible to vest.

If, prior to aone-yearnon-competition covenant change in control, (i) the Company terminates Ms. Teffner’s employment as Interim Executive Chair of the Board without “Cause” (as defined in the Omnibus Incentive Plan) and Ms. Teffner does not continue to serve as a member of the Board or (ii) Ms. Teffner has a “Termination of Directorship” (as defined in the Omnibus Incentive Plan) other than due to her resignation or her removal for “cause” under Delaware law, she will become vested in a pro-rata portion of the performance-based RSUs and performance-based stock options for which the applicable Hurdle was achieved prior to her termination.

In the event of Ms. Teffner’s termination as Interim Executive Chair of the Board or as a member of the Board due to her death or “Disability” (as defined in the Omnibus Incentive Plan) prior to the second anniversary of the grant date of the Appointment Grant, Ms. Teffner (or her estate or legal representative, as applicable) will receive full vesting of the performance-based RSUs and performance-based stock options for which the applicable Hurdle was actually achieved prior to her termination due to death or disability.

|

| | |

| Ascena Retail Group, Inc. | 56 | 2019 Proxy Statement |

If, upon a change in control, (i) Ms. Teffner’s employment as Interim Executive Chair of the Board is terminated by the Company without Cause and Ms. Teffner does not continue to serve as a member of the Board or (ii) Ms. Teffner has a Termination of Directorship (other than due to her resignation or her removal for “cause” under Delaware law), in either case while serving on the Board after her employment as Interim Executive Chair of the Board ends due to the appointment of a Non-Executive Chair of the Board (each, a “Change in Control Termination”), and on or prior to the date of such Change in Control Termination, the $3 Hurdle was actually achieved, Ms. Teffner will become vested in a portion of the performance-based RSUs and performance-based stock options based on linear interpolation between the closing price of the Company’s common stock for the 20-consecutive trading day period immediately preceding the Change in Control Termination (the “Teffner Termination Date Price”) and the Hurdles between which the Teffner Termination Date Price falls.

Other than with respect to accelerated or continued vesting of the Appointment Grant as described above, Ms. Teffner is not entitled to receive cash severance or other termination payments or benefits under the Teffner Offer Letter or the Executive Severance Plan.

Ms. Teffner is subject to non-competition and non-solicitation restrictions, as well as confidentiality and non-disclosure obligations.

For further information regarding Ms. Teffner’s employment arrangements and the payments to which he may be entitled thereunder, see below under “Potential Payments Upon Termination or Change in Control - Carrie W. Teffner.”

Dan Lamadrid

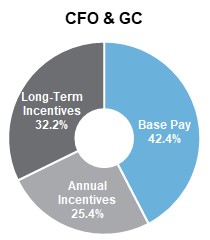

Effective August 4, 2019, the Company entered into an employment letter with Dan Lamadrid in connection with his appointment as Executive Vice President and CFO (the “Lamadrid Offer Letter”). The Lamadrid Offer Letter supersedes Mr. Lamadrid’s August 23, 2017, employment offer letter with the Company.

Pursuant to the Lamadrid Offer Letter, Mr. Lamadrid receives a base salary of $600,000 per year and is eligible to participate in the Company’s performance-based incentive compensation program at a target level of 75% of Mr. Lamadrid’s base salary (with a maximum payout opportunity of 200% of target, or $900,000).

Pursuant to the Lamadrid Offer Letter, on October 2, 2019, Mr. Lamadrid received a grant of 100,000 time-vesting stock options (the “Time-Based Options”) and atwo-yearnon-solicitation covenant grant of 50,000 performance-vesting stock options (the “Performance-Based Options”). Subject to Mr. Lamadrid’s continued employment, the Time-Based Options will vest in favorequal installments on the first and second anniversaries of the Company.grant date. Subject to Mr. Lamadrid’s continued employment, the Performance-Based Options are eligible to vest in accordance with the same vesting terms that apply to Mr. Muto’s Promotion Grant.

If a Hurdle is actually achieved prior to the second anniversary of the grant date of the Performance-Based Options, the portion of the Performance-Based Options related to the Hurdle that was achieved prior to the second anniversary will vest on the second anniversary, subject to Mr. Lamadrid’s continued employment. Any portion of the Performance-Based Options related to a Hurdle that is not actually achieved by the third anniversary of the grant date will be forfeited for no consideration.

If Mr. Lamadrid’s employment is terminated by the Company without “Cause” (as defined in the Lamadrid Offer Letter) prior to a change in control of the Company, he will become vested in a pro-rata portion of the Performance-Based Options for which the applicable Hurdle was achieved prior to his termination.

If Mr. Lamadrid’s employment with the Company terminates due to his death or disability prior to the second anniversary of the grant date of the Performance-Based Options, Mr. Lamadrid (or his estate or legal representative, as applicable) will receive full vesting of the Performance-Based Options for which the applicable Hurdle was actually achieved prior to his termination due to death or disability.

If Mr. Lamadrid has a Change in Control Related Termination on or within 24 months following a change in control, and on or prior to the date of such termination the $3 Hurdle was actually achieved, Mr. Lamadrid will become vested in a portion of the Performance-Based Options based on linear interpolation between the closing price of the Company’s common stock for the 20-consecutive trading day period immediately preceding the date of Mr. Lamadrid’s termination (the “Lamadrid Termination Date Price”) and the Hurdles between which the Lamadrid Termination Date Price falls. If Mr. Lamadrid has a Change in Control Related Termination within 90 days prior to a change in control, and on or prior to the date that the change in control is consummated the $3 Hurdle is achieved, the cash payment Mr. Lamadrid is entitled to receive pursuant to the Executive Severance Plan will include payment in respect of a portion of the Performance-Based Options based on linear interpolation between the closing price of the Company’s common stock for the 20-consecutive trading day period immediately preceding the change in control (the “CIC Closing Date Price”) and the Hurdles between which the CIC Closing Date Price falls.

The long-term incentive awards granted to Mr. Lamadrid prior to August 24, 2017, 4, 2019, remain outstanding and are eligible to vest in accordance with their terms.

Mr. Muto becameLamadrid is subject to non-competition and non-solicitation restrictions, as well as confidentiality and non-disclosure obligations.

In addition to the Lamadrid Offer Letter, the Company and Mr. Lamadrid entered into a retention letter dated as of May 1, 2019 (the “Retention Letter”). Under the Retention Letter, subject to Mr. Lamadrid’s continued employment through August 31, 2020, he will

|

| | |

| Ascena Retail Group, Inc. | 57 | 2019 Proxy Statement |

receive a lump sum payment of $275,000. Pursuant to the Retention Letter, Mr. Lamadrid received a lump sum payment of $275,000 in May 2019.

Mr. Lamadrid will continue to be a participant in the Executive Severance Plan, subject to the terms and conditions of the Executive Severance Plan, with certain modifications as set forth in the Retention Letter, which are described below under the heading “Executive Severance Plan.”

For further information regarding Mr. Lamadrid’s employment arrangements and the payments to which he may be entitled thereunder, see below under “Potential Payments Upon Termination or Change in Control - Dan Lamadrid.”

Wendy Hufford

Effective October 1, 2018, the Company entered into an employment letter with Wendy Hufford in connection with her appointment as General Counsel (the “Hufford Offer Letter”).

Pursuant to the Hufford Offer Letter, Ms. Hufford receives a base salary of $400,000 and is eligible to participate in the Company’s seasonal performance-based incentive compensation program at a target level of 60% of Ms. Hufford’s base salary (with a maximum payout opportunity of 200% of target). Pursuant to the Hufford Offer Letter, Ms. Hufford received a one-time cash sign on bonus of $100,000. In addition, Ms. Hufford’s incentive bonuses for the fall and spring seasons of the Company’s 2019 fiscal year were guaranteed at target.

Pursuant to the Hufford Offer Letter, Ms. Hufford’s Incentive Plan, with a target opportunity of 76% of base salary which may be comprised of a combination of stock options, RSUs and/or cash LTIP. The Hufford Offer Letter provides that Ms. Hufford’s Long Term Incentive Plan Award from the October 2018 Board meeting will be granted as 60% in Cash LTIP vesting after a three-year performance period, 20% stock options vesting 50% each year, and 20% RSUs vesting 50% each year.

Ms. Hufford is subject to non-competition and non-solicitation restrictions, as well as confidentiality and non-disclosure obligations.

Ms. Hufford is eligible to participate in the Company’s Executive Severance Plan, subject to the terms and conditions of the ESP, but with certain modifications, including that his cash severance payment level relatingExecutive Severance Plan.

For further information regarding Ms. Hufford’s employment arrangements and the payments to anon-changewhich she may be entitled thereunder, see below under “Potential Payments Upon Termination or Change in control termination will be 24 months of base salary, and his cash severance level relating to a change in control related termination will be 24 months of base salary and bonus.Control - Wendy Hufford.”

John Pershing

Robb Giammatteo

Mr.

Pershing hasGiammatteo had an employment letter with the Company that was entered into on

JanuaryJuly 25, 2015, which

providesprovided that he

is entitled towould receive a base salary of at least

$525,000$500,000 per year, as well as standard Company benefits.

The Company and Mr. Giammatteo entered into a retention letter dated as of May 1, 2019, pursuant to which Mr. Giammatteo was eligible to receive an aggregate retention bonus of $700,000 subject to his continued employment. Mr. Giammatteo forfeited the retention bonus upon his departure from the Company.

Mr. Giammatteo was also eligible to participate in the Executive Severance Plan, subject to the terms and conditions of the Executive Severance Plan, with certain modifications as set forth in Mr. Giammatteo’s retention letter, which are described below under the heading “Executive Severance Plan.”

SEPARATION AGREEMENTS

David Jaffe

Effective May 1, 2019, the Company entered into a transition and separation agreement and general release with David Jaffe in connection with his retirement, pursuant to which Mr. Jaffe is entitled to receive severance payments and other benefits in accordance with the terms of his employment offer letter dated as of July 29, 2017, consisting of the following payments and benefits:

continued payment of Mr. Jaffe’s base salary for a period of 24 months following termination, totaling $2,000,000;

Company-paid COBRA continuation coverage for up to 18 months, subject to his continued payment of premiums at the applicable active rate, plus a payment of $2,000 per month from the Company; and

a lump sum payment equal to the Spring season short-term incentive award Mr. Jaffe would be entitled to receive, based on actual performance and pro-rated for the portion of the Spring season that Mr. Jaffe was employed (the amount of such payment was $0 based on actual performance for the Spring season).

In addition, as of June 27, 2019, Mr. Jaffe satisfied the “Total Years Test” with respect to any then outstanding stock options and RSUs granted to him under the Omnibus Incentive Plan (and any predecessor plan). As a result of Mr. Jaffe’s continued service as a senior advisor through June 28, 2019, and satisfying the Total Years Test, Mr. Jaffe’s outstanding stock options continued to vest in accordance with their terms and all of Mr. Jaffe’s outstanding RSUs became immediately vested (the value of the RSUs that became

| | | | |

| |  | | |

| Ascena Retail Group, Inc. | 58 | 52 | | 20182019 Proxy Statement |

PROPOSAL FOURTHREE — APPROVAL OF THEAN AMENDMENT AND RESTATEMENT OFTO THE COMPANY’S SECONDTHIRD AMENDED AND RESTATED CERTIFICATE OF INCORPORATION AS AMENDEDTO EFFECT A REVERSE STOCK SPLIT OF THE COMPANY’S COMMON STOCK AND A CORRESPONDING REDUCTION IN THE COMPANY’S AUTHORIZED SHARES OF COMMON STOCK

Ascena is asking stockholders to adopt and Corporate Governance Committee conducted a review of the Company’s Secondapprove eleven alternative amendments to our Third Amended and Restated Certificate of Incorporation as amendedto effect a reverse stock split (the “Existing Certificate”“Reverse Stock Split”), of our issued and outstanding common stock and to determine whether any provisions should be amendedreduce the number of authorized shares of our common stock by a corresponding ratio (collectively, the “Reverse Stock Split Amendment”). On October 2, 2019, our Board unanimously approved and declared advisable the proposed Reverse Stock Split Amendment, and recommends that our stockholders adopt and approve the proposed Reverse Stock Split Amendment. If approved by stockholders, this proposal will authorize eleven alternative amendments to our Third Amended and Restated Certificate of Incorporation to effect the Reverse Stock Split at a ratio of each whole number in lightthe range of current law or market practices. After careful consideration1-for-15 to 1-for-25, and reviewto effect a corresponding reduction in the number of the Existing Certificate,Company’s authorized shares of common stock. The actual ratio in this range at which the Reverse Stock Split and the corresponding reduction in the number of the Company’s authorized shares of common stock will be effected will be determined by the Board basedof Directors prior to the effectiveness of the Reverse Stock Split Amendment, and the alternative amendments to our Third Amended and Restated Certificate of Incorporation with respect to each other whole number ratio in this range will be abandoned.

The effective date of the Reverse Stock Split will be determined at the discretion of the Board, and may occur as soon as the day of the 2019 annual meeting, or at any time prior to the 2020 annual meeting. The effective date of the Reverse Stock Split will be publicly announced by Ascena. The Board may determine in its discretion not to effect the Reverse Stock Split and not to file any amendment to our Third Amended and Restated Certificate of Incorporation.

The number of authorized shares of our common stock after giving effect to the Reverse Stock Split, if and when effected, will depend on the recommendationReverse Stock Split ratio that is ultimately determined by the Board and reflected in the Reverse Stock Split Amendment filed with the Delaware Secretary of State. As of October 15, 2019, we had 360,000,000 shares of authorized common stock and [198,000,000] shares of common stock issued and outstanding. The proposed Reverse Stock Split Amendment would result in a reduction of the Leadershiptotal number of shares of Ascena common stock that we are authorized to issue by a corresponding ratio.

The table below illustrates (as of August 3, 2019) the impact of the Reverse Stock Split ratio as a result of three illustrative alternative amendments along with the corresponding effect (without consideration of the number of resulting fractional shares of common stock that will be exchanged for cash) on:

The number of shares of authorized common stock as adjusted to correspond with the Reverse Stock Split ratio;

The number of shares of common stock issued and Corporate Governance Committee,outstanding;

The number of shares of common stock reserved for future issuance under our equity compensation plans; and

The number of shares of common stock that will remain authorized and available for issuance, including treasury shares.

|

| | | | |

| STATUS | SHARES OF COMMON STOCK AUTHORIZED | SHARES OF COMMON STOCK ISSUED AND OUTSTANDING | SHARES OF COMMON STOCK RESERVED FOR FUTURE ISSUANCE (including options and RSUs) | SHARES OF COMMON STOCK AVAILABLE FOR FUTURE ISSUANCE |

| Pre-Reverse Stock Split | 360,000,000 | 198,499,319 | 24,365,498 | 18,764,734 |

| After 1:15 Reverse Stock Split | 24,000,000 | 12,233,288 | 1,624,367 | 1,250,982 |

| After 1:20 Reverse Stock Split | 18,000,000 | 9,924,966 | 1,218,275 | 938,237 |

| After 1:25 Reverse Stock Split | 14,400,000 | 7,939,973 | 974,620 | 750,589 |

The examples in the table above are presented for illustrative purposes only, and the Board may elect to effect the Reverse Stock Split at a ratio of any whole number in the range of 1-for-15 to 1-for-25 if this proposal is approved by our stockholders.

If we effect the Reverse Stock Split, then, except for adjustments that may result from the treatment of fractional shares as described below, each stockholder will hold the same percentage of the then-outstanding shares of common stock immediately following the Reverse Stock Split that such stockholder held immediately prior to the Reverse Stock Split. The par value of our common stock will remain unchanged at $0.01 per share. No fractional shares of common stock will be issued as a result of the Reverse Stock Split.

|

| | |

| Ascena Retail Group, Inc. | 68 | 2019 Proxy Statement |

Instead, any stockholder who would be entitled to receive a fractional share as a result of the Reverse Stock Split will receive a cash payment in lieu of such fractional share.

If the proposed Reverse Stock Split Amendment is adopted and approved by our stockholders and the Board elects to effect the Reverse Stock Split, we will file a Certificate of Amendment to our Third Amended and Restated Certificate of Incorporation with the Delaware Secretary of State, substantially in the form of the Certificate of Amendment attached as Annex A to this proxy statement, that sets forth the Reverse Stock Split Amendment and the Reverse Stock Split ratio as determined by the Board, and each other alternative amendment contemplated by this proposal will be abandoned. The Certificate of Amendment will be effective immediately upon filing with the Delaware Secretary of State or such later time as is set forth therein. The Board also may determine in its discretion to abandon each such amendment, not effect the Reverse Stock Split and not file any Certificate of Amendment with respect to any of the alternative amendments contemplated by this proposal.

Background and Reasons for the Reverse Stock Split

On July 29, 2019, the Company received a notification letter from the Listings Qualifications department staff of The Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that it had failed to maintain a minimum closing bid price of $1.00 per share for the shares of its common stock for a period of 30 consecutive business days as required by Nasdaq Listing Rule 5450(a)(1) (the “Bid Price Rule”) for continued listing on The Nasdaq Global Select Market. The notification does not affect the listing of the Company’s common stock at this time, and the Company’s shares have continued to trade on The Nasdaq Global Select Market under the symbol “ASNA”.

The letter provides that Ascena has 180 calendar days, or until January 27, 2020, to regain compliance with the Bid Price Rule by maintaining a closing bid price of $1.00 per share for a minimum of ten consecutive business days. If at any time during such 180-day period the bid price of Ascena’s common stock closes at $1.00 per share or more for a minimum of ten consecutive business days, Nasdaq will notify Ascena that it has achieved compliance with the Bid Price Rule.

If the Company does not regain compliance with the Bid Price Rule by January 27, 2020, the Company may submit a transfer application to The Nasdaq Capital Market in order to receive an additional 180 calendar day period to comply, provided that the Company meets the continued listing requirement for market value of publicly held shares and all other initial listing standards for The Nasdaq Capital Market, other than the Bid Price Rule, and provides written notice to Nasdaq of its intention to cure the deficiency during the additional compliance period.

If the Company does not regain compliance with the Bid Price Rule by January 27, 2020 and is not eligible for an additional compliance period at that time, Nasdaq will notify the Company that its common stock may be delisted. At that time, the Company may appeal the decision to a Listing Qualifications Panel.

We believe that the Reverse Stock Split, by increasing our stock price, will make our common stock more attractive to a broader range of institutional and other investors. Many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. Some of those policies and practices may function to make the processing of trades in low-priced stocks economically unattractive to brokers. Because brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, the current trading prices of our common stock can result in individual stockholders paying transaction costs that are a higher percentage of the value of the transaction than would be the case if the share price were substantially higher. We believe that the Reverse Stock Split, when effected, will make our common stock a more attractive and cost-effective investment for many investors.

Our Board has determined that it is advisable and in the best interests of the Company and its stockholders to amend and restatemaintain the Existing Certificatelisting of Ascena common stock on Nasdaq. We may not be able to incorporateregain compliance with the changes described below. We referBid Price Rule unless we effect the Reverse Stock Split. Our Board recommends approval of the proposed Reverse Stock Split Amendment so that the Reverse Stock Split may be implemented to the Existing Certificateextent necessary to maintain the listing of our common stock on The Nasdaq Global Select Market.

Reducing the number of outstanding shares of our common stock through the Reverse Stock Split is intended, absent other factors, to increase the per share market price of our common stock. However, other factors, such as our financial results, market conditions and the market perception of our business, may adversely affect the market price of our common stock. As a result, there can be no assurance that the Reverse Stock Split, if implemented, will produce the intended results, that the market price of our common stock will increase following the implementation of the Reverse Stock Split or that the market price of our common stock will not decrease in the future. Additionally, we cannot assure you that the market price per share of our common stock after the Reverse Stock Split will increase in proportion to the reduction in the number of shares of our common stock outstanding before the Reverse Stock Split. Accordingly, the total market capitalization of our common stock after the Reverse Stock Split may be lower than the total market capitalization before the Reverse Stock Split.

The Delaware General Corporation Law does not require a reduction in the total number of authorized shares of our common stock at the time of the Reverse Stock Split. However, as a matter of good governance, our Board has determined to implement a pro-rata reduction in the total number of authorized shares of common stock at the time of the Reverse Stock Split. Accordingly, if stockholders adopt and approve the proposed Reverse Stock Split Amendment and the Reverse Stock Split is implemented, the authorized number of shares of our common stock also will be reduced by a corresponding ratio.

|

| | |

| Ascena Retail Group, Inc. | 69 | 2019 Proxy Statement |

Board Discretion to Implement the Reverse Stock Split

The Board believes that stockholder adoption and approval of the alternative amendments reflecting the Reverse Stock Split at a ratio of each whole number within the range of 1-for-15 to 1-for-25 is in the best interests of our stockholders because it provides the Board and the Company with the proposedflexibility to achieve the desired results of the Reverse Stock Split and because it is not possible to predict market conditions at the time the Reverse Stock Split is implemented. If our stockholders approve this proposal, the Board will implement the Reverse Stock Split only upon a determination that the Reverse Stock Split is in the best interests of the stockholders at that time. The Board will then select the ratio for the Reverse Stock Split from the alternative amendments described below as the “Restated Certificate.” If the proposal to approve the Restated Certificate isadopted and approved by the requisite votestockholders that the Board determines to be advisable and in the best interests of the Company’s stockholders, considering relevant market conditions at the time the Reverse Stock Split is to be implemented. The factors that the Board may consider in determining the Reverse Stock Split ratio include, but are not limited to, the following:

the historical and projected trading price and trading volume of our common stock;

general economic and other related conditions prevailing in our industry and in the marketplace;

our ability to meet the continued listing standards of Nasdaq, including the Bid Price Rule; and

the anticipated impact of a particular ratio on our ability to reduce administrative and transactional costs.

The Board intends to select the Reverse Stock Split ratio that it believes will be most likely to achieve the anticipated benefits of the Reverse Stock Split described above. The Reverse Stock Split is not intended as, and will not have the effect of, a “going private transaction” covered by Rule 13e-3 under the Exchange Act. Following the implementation of the Reverse Stock Split, we intendwill continue to filebe subject to the periodic reporting requirements of the Exchange Act.

Certain Risks and Potential Disadvantages Associated with the Reverse Stock Split

We cannot assure you that the proposed Reverse Stock Split will increase our stock price. We expect that the Reverse Stock Split will increase the per share trading price of our common stock. However, the effect of the Reverse Stock Split on the per share trading price of our common stock cannot be predicted with any certainty, and the history of reverse stock splits for other companies is varied. It is possible that the per share trading price of our common stock after the Reverse Stock Split will not increase in the same proportion as the reduction in the number of our outstanding shares of common stock following the Reverse Stock Split. In addition, although we believe the Reverse Stock Split may enhance the marketability of our common stock to certain potential investors, we cannot assure you that, if implemented, our common stock will be more attractive to investors. Even if we implement the Reverse Stock Split, the per share trading price of our common stock may decrease due to factors unrelated to the Reverse Stock Split, including our future performance. If the Reverse Stock Split is consummated and the per share trading price of our common stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of the Reverse Stock Split.

We cannot assure you that we will regain and continue in compliance with the continued listing criteria of Nasdaq. Even if our stockholders adopt and approve the proposed Reverse Stock Split Amendment and the Reverse Stock Split is effected, there can be no assurance that we will regain compliance with the Nasdaq continued listing criteria and/or continue to meet the Nasdaq continued listing criteria.

The proposed Reverse Stock Split may decrease the liquidity of our common stock and result in higher transaction costs. The liquidity of our common stock may be negatively impacted by the Reverse Stock Split, given the reduced number of shares that will be outstanding after the Reverse Stock Split, particularly if the per share trading price does not increase as a result of the Reverse Stock Split. In addition, if the Reverse Stock Split is implemented, it may increase the number of our stockholders who own “odd lots” of fewer than 100 shares of common stock. Brokerage commissions and other costs of transactions in odd lots are generally higher than the costs of transactions of more than 100 shares of common stock. Accordingly, the Reverse Stock Split may not achieve the desired result of increasing the marketability of our common stock.

Effects of the Reverse Stock Split

General

The principal effect of the Reverse Stock Split, if implemented by the Board, would be to proportionately decrease the number of issued and outstanding shares of our common stock based on the ratio selected by our Board, which will result in each stockholder owning a reduced number of shares of common stock after the effective date of the Reverse Stock Split. The actual number of shares issued and outstanding and ultimately owned by each stockholder after giving effect to the Reverse Stock Split, if implemented, would depend on the ratio for the Reverse Stock Split that is ultimately determined by our Board. The Reverse Stock Split would affect all holders of our common stock uniformly and would not affect any stockholder’s percentage ownership interest in the Company, except that, as described below under “Mechanics of the Reverse Stock Split-Fractional Shares,” holders of common stock otherwise entitled to a fractional share as a result of the Reverse Stock Split would receive cash in lieu of such fractional share. In addition, the Reverse Stock Split would not affect any stockholder’s proportionate voting power, subject to the treatment of fractional shares.

The Reverse Stock Split may result in some stockholders owning “odd lots” of less than 100 shares of common stock. Odd lot shares may be more difficult to sell, and brokerage commissions and other costs of transactions in odd lots may be higher than the costs of transactions in “round lots” of even multiples of 100 shares.

|

| | |

| Ascena Retail Group, Inc. | 70 | 2019 Proxy Statement |

After the effective time of the Reverse Stock Split, our common stock will have a new Committee on Uniform Securities Identification Procedures, or CUSIP, number, which is a number used to identify our common stock.

Effect on Capital Stock

Pursuant to our Third Amended and Restated Certificate of Incorporation, our capital stock consists of 360,100,000 shares, which includes 360,000,000 shares of common stock, par value $0.01, and 100,000 shares of preferred stock, par value $0.01 per share, none of which are outstanding. The proposed Reverse Stock Split will have no impact on the total authorized number of shares of preferred stock or the par value of the preferred stock, and will have no impact on the par value of the common stock. If the proposed Reverse Stock Split is implemented, the shares of authorized common stock will be reduced in proportion to the Reverse Stock Split ratio selected by the Board as illustrated in the table above. As a result, if and when the Reverse Stock Split is effected, the same proportion of authorized but unissued shares of common stock to shares of common stock authorized and issued (or reserved for issuance, including treasury shares) would be maintained (except for any changes as a result of the treatment of fractional shares). If the Reverse Stock Split is abandoned, the decrease in the number of authorized shares will also be abandoned.

Accounting Matters

As a result of the Reverse Stock Split, at the effective time of the Reverse Stock Split, the stated capital on the Company’s balance sheet attributable to our common stock, which consists of the par value per share of our common stock multiplied by the aggregate number of shares of our common stock issued and outstanding, will be reduced in proportion to the Reverse Stock Split ratio chosen by the Board. Correspondingly, the Company’s additional paid-in capital account, which consists of the difference between the Company’s stated capital and the aggregate amount paid to the Company upon issuance of all currently outstanding shares of common stock, will be credited with the amount by which the stated capital is reduced. The Company’s stockholders’ equity, in the aggregate, will remain unchanged. The historical earnings or loss per share of our common stock reported in all financial reports published after the effective date of the Reverse Stock Split will be restated to reflect the proportionate decrease in the number of outstanding shares of common stock for all periods presented so that the results are comparable.

Effect on the Company’s Omnibus Incentive Plan and Employee Stock Purchase Plan

The proposed Reverse Stock Split will reduce the number of shares of common stock available for issuance under our equity compensation plans in proportion to the Reverse Stock Split ratio selected by the board. As of October 15, 2019, we had approximately [____________] shares of unvested restricted stock, [______________] shares subject to unvested restricted stock units and [_____________] shares subject to stock options outstanding under our plans. Under the terms of our 2016 Omnibus Incentive Plan, the proposed Reverse Stock Split would cause a reduction in the number of shares of common stock issuable upon exercise, vesting or conversion of such awards in proportion to the Reverse Stock Split ratio and would cause a proportionate increase in any exercise price of such awards, with any resulting fractional shares rounded up to the next whole share. The Compensation Committee has also authorized any changes to our stock incentive plans that are necessary, desirable or appropriate to give effect to the Reverse Stock Split, if any, including any applicable, technical conforming changes. The shares held in the employee stock purchase plan will be reduced in proportion to the Reverse Stock Split ratio. The employee stock purchase plan provides for fractional shares to be held by participants; therefore, fractional shares will be credited to the participants’ accounts.

Mechanics of the Reverse Stock Split

Holders of registered shares of our common stock that hold only in book-entry form do not need to take any action to receive post-Reverse Stock Split shares of our common stock in registered book-entry form or your cash payment in lieu of fractional shares, if applicable. If you hold any shares in certificated form you will receive separate instructions from our transfer agent. If you are entitled to post-Reverse Stock Split shares of our common stock, a transaction statement will automatically be sent to your address of record as soon as practicable after the effective time of the Reverse Stock Split indicating the number of shares of our common stock you then hold. In addition, if you are entitled to a payment of cash in lieu of fractional shares, a check will be mailed to you at your registered address as soon as practicable after the effective time. By signing and cashing this check, you will warrant that you owned the shares of Ascena common stock for which you received the cash payment.

If you hold your shares of common stock in street name, your broker, bank or other intermediary will be instructed to effect the Reverse Stock Split for their beneficial holders holding shares of our common stock in “street name” in the same manner as registered holders; however, these brokers, banks or other intermediaries may apply their own specific procedures for processing the Reverse Stock Split. If you hold your shares of our common stock with a broker, bank or other intermediary, and you have any questions in this regard, we encourage you to contact your bank, broker or other intermediary.

If you hold any of your shares of our common stock in certificate form, you will receive a transmittal letter from our transfer agent as soon as practicable after the effective time of the Reverse Stock Split. The transmittal letter will be accompanied by instructions specifying how you can deliver your stock certificates to the transfer agent and exchange them for shares of common stock held in book-entry form. We will not issue new certificates, and following the Reverse Stock Split, shares will be held only in book-entry form. Stockholders will not have to pay any transfer fee or other fee in connection with such exchange. As soon as practicable after your delivery to the transfer agent of the transmittal letter and your stock certificate(s), you will receive a transaction statement showing the post-Reverse Stock Splits shares of common stock you own in book-entry form together with any payment of cash in lieu of fractional shares to which you are entitled. After the effective time of the Reverse Stock Split, any shares of common stock you hold in certificate from representing pre-split shares of common stock cannot be traded for value, other than in accordance with the exchange procedures described above, and cannot be used for either transfers or deliveries of your shares to other persons. Accordingly, you much

|

| | |

| Ascena Retail Group, Inc. | 71 | 2019 Proxy Statement |

exchange your stock certificates for shares held in book-entry form in order to trade your shares for value or to effect transfers or deliveries of your shares after the Reverse Stock Split.

As soon as practicable after the surrender to the transfer agent of any stock certificates, together with a properly completed and duly executed transmittal letter and any other documents the transfer agent may specify, the transfer agent will adjust its records to reflect that the shares of common stock represented by such stock certificates are held in book-entry form in the name of such person.

Fractional Shares

Stockholders will not receive fractional shares of common stock in connection with the Reverse Stock Split. Instead, the transfer agent will aggregate all fractional shares and sell them as soon as practicable after the effective time at the then-prevailing prices on the open market, on behalf of those stockholders who would otherwise be entitled to receive a fractional share as a result of the Reverse Stock Split. We expect that the transfer agent will conduct the sale in an orderly fashion at a reasonable pace and that it may take several days to sell all of the aggregated fractional shares of our common stock. After the transfer agent’s completion of such sale, stockholders who would have been entitled to a fractional share will instead receive a cash payment from the transfer agent in an amount equal to their respective pro-rata shares of the total proceeds of that sale net of any brokerage costs incurred by the transfer agent to sell such stock. The cash payment is subject to applicable U.S. federal and state income tax and state abandoned property (or escheat) laws. After the Reverse Stock Split, a stockholder will have no further interest in the Company with respect to any fractional share interest, and a stockholder otherwise entitled to a fractional share will not have any voting, dividend or other rights with respect to the fractional share except the right to receive a cash payment as described above. Stockholders will not be entitled to receive interest for the period of time between the effective time of the Reverse Stock Split and the date payment is made for their fractional share interests.

In addition, under the escheat laws of certain states, funds due for fractional share interests that are not timely claimed after the funds are made available may be required to be paid to the designated agent for each such state. Thereafter, stockholders otherwise entitled to receive such funds may have to obtain the funds directly from the state to which they were paid.

If you do not hold sufficient shares of Ascena common stock at the effective time of the Reverse Stock Split to receive at least one share following the Reverse Stock Split, you will receive cash and will no longer be a holder of Ascena common stock. Shares of our common stock held in “street name” by your broker, bank or other intermediary for the same shareholder will be considered to be held in separate accounts and will not be aggregated when effecting the Reverse Stock Split and determining fractional share interests.

Effective Time

The effective time of the Reverse Stock Split, if the proposed Reverse Stock Split Amendment is adopted and approved by stockholders and the Reverse Stock Split is implemented at the direction of the Board, will be the date and time that the Certificate of Amendment effecting the amendment with the ratio selected by the Board is filed with the Delaware Secretary of State

ofor such later time as is specified therein. Such filing may occur as soon as the

State of Delaware promptly afterday following the Annual Meeting

or at

whichany time

itprior to the 2020 annual meeting of stockholders. However, the exact timing of the Reverse Stock Split will be

effective immediately.Proposed Changes to the Existing Certificate

Thedetermined by our Board based on its evaluation as to when such action will be the recommendationmost advantageous to Ascena and its stockholders.

The Reverse Stock Split may be delayed or abandoned without further action by the stockholders at any time prior to the filing and effectiveness of the LeadershipCertificate of Amendment with the Delaware Secretary of State, notwithstanding stockholder adoption and Corporate Governance Committee, adopted resolutions approvingapproval of each of the amendments effecting the proposed Reverse Stock Split, if the Board, in its sole discretion, determines that it is in the best interests of the Company and declaring advisable,its stockholders to delay or abandon the Reverse Stock Split. If the Certificate of Amendment implementing the Reverse Stock Split has not been filed with the Delaware Secretary of State on or before the date of the 2020 annual meeting of stockholders, the Board will be deemed to have abandoned each alternative amendment effecting the Reverse Stock Split. In addition, if a Certificate of Amendment effecting the Reverse Stock Split is filed and recommendingbecomes effective, the alternative amendments reflecting the other proposed ratios will be deemed to have been abandoned.

Appraisal Rights

Under the Delaware General Corporation Law, our stockholders are not entitled to dissenter’s rights or appraisal rights with respect to the Reverse Stock Split and we will not independently provide our stockholders with any such rights.

Interest of Certain Persons in Matters to be Acted Upon

No officer or director has any substantial interest, direct or indirect, by security holdings or otherwise, in the Reverse Stock Split that is not shared by all of our other stockholders.

Certain U.S. Federal Income Tax Consequences of the Reverse Stock Split

The following discussion is a general summary of certain U.S. federal income tax consequences of the Reverse Stock Split that may be relevant to stockholders for U.S. federal income tax purposes. This summary is based upon the provisions of the Internal Revenue Code of 1986, as amended (the “Code”), Treasury regulations promulgated thereunder, administrative rulings and judicial decisions as of the date of this proxy statement, all of which may change, possibly with retroactive effect, resulting in U.S. federal income tax consequences that may differ from those discussed below.

This discussion applies only to holders of our common stock that are U.S. Holders (as defined below) and does not address all aspects of federal income taxation that may be relevant to such holders in light of their particular circumstances or to holders that may be subject to special tax rules, including: (i) holders subject to the alternative minimum tax; (ii) banks, insurance companies, or other

|

| | |

| Ascena Retail Group, Inc. | 72 | 2019 Proxy Statement |

financial institutions; (iii) tax-exempt organizations; (iv) dealers in securities or commodities; (v) regulated investment companies or real estate investment trusts; (vi) partnerships (or other flow-through entities for U.S. federal income tax purposes and their partners or members); (vii) traders in securities that elect to use a mark-to-market method of accounting for their securities holdings; (viii) U.S. Holders whose “functional currency” is not the U.S. dollar; (ix) persons holding our common stock as a position in a hedging transaction, “straddle,” “conversion transaction” or other risk reduction transaction; (x) persons who acquire shares of our common stock in connection with employment or other performance of services; or (xi) U.S. expatriates. If a partnership (including any entity or arrangement treated as a partnership for U.S. federal income tax purposes) holds shares of our common stock, the tax treatment of a holder that is a partner in the partnership generally will depend upon the status of the partner and the activities of the partnership.

We have not sought, and will not seek, an opinion of counsel or a ruling from the Internal Revenue Service (“IRS”) regarding the U.S. federal income tax consequences of the Reverse Stock Split and there can be no assurance that the Company’s stockholders approve,IRS will not challenge the Restated Certificate,statements and conclusions set forth below or that a court would not sustain any such challenge. The following summary does not address any U.S. state or local or any foreign tax consequences, any estate, gift or other non-U.S. federal income tax consequences, or the Medicare tax on net investment income.

EACH HOLDER OF COMMON STOCK SHOULD CONSULT SUCH HOLDER’S OWN TAX ADVISOR WITH RESPECT TO THE PARTICULAR TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT TO SUCH HOLDER.

For purposes of the discussion below, a “U.S. Holder“ is a beneficial owner of shares of our common stock that for U.S. federal income tax purposes is: (1) an individual citizen or resident of the United States; (2) a corporation (including any entity taxable as more fully reflected onAnnex B (the texta corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States, or any state or political subdivision thereof; (3) an estate the income of which is subject to revision for such changes as may be required byU.S. federal income taxation regardless of its source; or (4) a trust, if (i) a court within the Secretary of StateUnited States is able to exercise primary supervision over the administration of the Statetrust and one or more U.S. persons have the authority to control all substantial decisions of Delawarethe trust or other changes consistent(ii) the trust has a valid election in effect to be treated as a U.S. person.

The Board intends the Reverse Stock Split to be treated as a “recapitalization” under Section 368(a)(1)(E) of the Code, although no assurances are provided in this regard. In such case, we should not recognize gain or loss in connection with

this Proposal Four that we deem necessarythe Reverse Stock Split. Also, a U.S. Holder generally should not recognize gain or

appropriate). The proposed changesloss upon the Reverse Stock Split, except with respect to cash received in lieu of a fractional share of our common stock, as discussed below. A U.S. Holder’s aggregate tax basis in the shares of our common stock received pursuant to the

Existing Certificate are intended to combine into one document a prior amendment and makeReverse Stock Split should equal the

change described below.Section 11(c) of the Existing Certificate provides that members of the Board may be removed from office only (1) for cause, by the remaining directors, or (2) with or without cause, by stockholder action, at a meeting of stockholders called for that purpose, by vote of at least 80 percentaggregate tax basis of the shares of capitalour common stock then entitledsurrendered (excluding any portion of such basis that is allocated to voteany fractional share of our common stock), and such U.S. Holder’s holding period in the shares of our common stock received should include the holding period in the shares of our common stock surrendered. Holders of shares of our common stock acquired on different dates and at an election of directors. Section 11(c)different prices should consult their own tax advisors regarding the allocation of the Restated Certificate amends Section 11(c)tax basis and holding period of such shares.

A U.S. Holder that receives cash in lieu of a fractional share of our common stock pursuant to the Reverse Stock Split should recognize capital gain or loss in an amount equal to the difference between the amount of cash received and the U.S. Holder’s tax basis in the shares of our common stock surrendered that is allocated to such fractional share. Such capital gain or loss should be long-term capital gain or loss if the U.S. Holder’s holding period for our common stock surrendered exceeded one year at the effective time of the Existing CertificateReverse Stock Split.

Payments of cash made in lieu of a fractional share of our common stock may, under certain circumstances, be subject to deleteinformation reporting and backup withholding. To avoid backup withholding, each holder of our common stock that does not otherwise establish an exemption must furnish on applicable IRS forms its taxpayer identification number and comply with the language referringapplicable certification procedures.

Backup withholding is not an additional tax and amounts withheld will be allowed as a credit against the holder’s U.S. federal income tax liability and may entitle such holder to

directors havinga refund, provided the

abilityrequired information is timely furnished to

remove other directors from the

boardIRS. Holders of

directors for cause.Reasons and Effectour common stock should consult their own tax advisors regarding the application of the Proposed Changes

information reporting and backup withholding rules to them.

Vote Required

Under

Section 141(k) of the Delaware General

CorporationCorporate Law,

(“DGCL”), directors are not authorized to remove other directors from the

boardaffirmative vote of

directors; such power is reserved for the stockholders of the Company. We are seeking to amend Section 11(c) of the Existing Certificate to delete the language referring to directors having the ability to remove other directors from the board of directors for cause to conform with the DGCL. This amendment would not affect the right of the Company’s stockholders to remove directors as currently set forth in the Existing Certificate.Vote Required

This proposal to amend and restate the Existing Certificate will be approved if the holders of at least 80%a majority of the outstanding shares of common stock entitled to vote at the Annual Meeting voteannual meeting is required to adopt and approve the proposed alternative amendments to our Third Amended and Restated Certificate of Incorporation to effect the Reverse Stock Split and the corresponding reduction in favorauthorized shares of common stock at a ratio of each whole number within the range of 1-for-15 to 1-for-25. Because adoption and approval of the proposed to our Third Amended and Restated Certificate of Incorporation to effect the Reverse Stock Split requires a majority of the outstanding shares, an abstention with respect to the Reverse Stock Split proposal will have the same effect as a vote ”against” the proposal.

Brokers have discretion to vote on this Proposal 3 pursuant to the rules of the NYSE, therefore, no broker non-votes are anticipated with respect to this proposal.THE BOARD UNANIMOUSLY RECOMMENDS A VOTEFOR THIS PROPOSAL.

| | | | |

| |  | | |

| Ascena Retail Group, Inc. | 73 | 69 | | 20182019 Proxy Statement |

Member

Member Member

Member Lead Independent Director

Lead Independent Director Financial Expert

Financial Expert